Can I Get Partial Money Back From Health Insurance Premium Tax 2017

How to reconcile your premium tax credit

If you had a Marketplace plan and used advance payments of the premium tax credit (APTC) to lower your monthly payment, yous'll have to "reconcile" when you file your federal taxes. This means y'all'll compare 2 figures:

-

The amount of premium revenue enhancement credit you used in advance during the twelvemonth. (This was paid direct to your health programme so your monthly payment was lower.)

-

The premium tax credit you actually qualify for based on your terminal income for the year.

Any difference between the two figures will affect your refund or tax owed.

- You should get your Form 1095-A in the mail by mid-Feb. Information technology may exist available in your HealthCare.gov account as soon equally mid-Jan. If you don't get it, or it's wrong, contact the Marketplace Call Center. Come across how to exist sure the information is correct.

Stride-by-pace guide to reconciling your premium taxation credit

Follow these steps:

-

Go your Course 1095-A.

-

Print Form 8962 (PDF, 110 KB) and instructions (PDF, 348 KB).

-

Utilize the information from your 1095-A course to complete Office Two of Grade 8962, using the table below as a guide.

| What information do I need from my 1095-A? | Where do I find it on my 1095-A? | Where do I enter it on Form 8962? | See how |

|---|---|---|---|

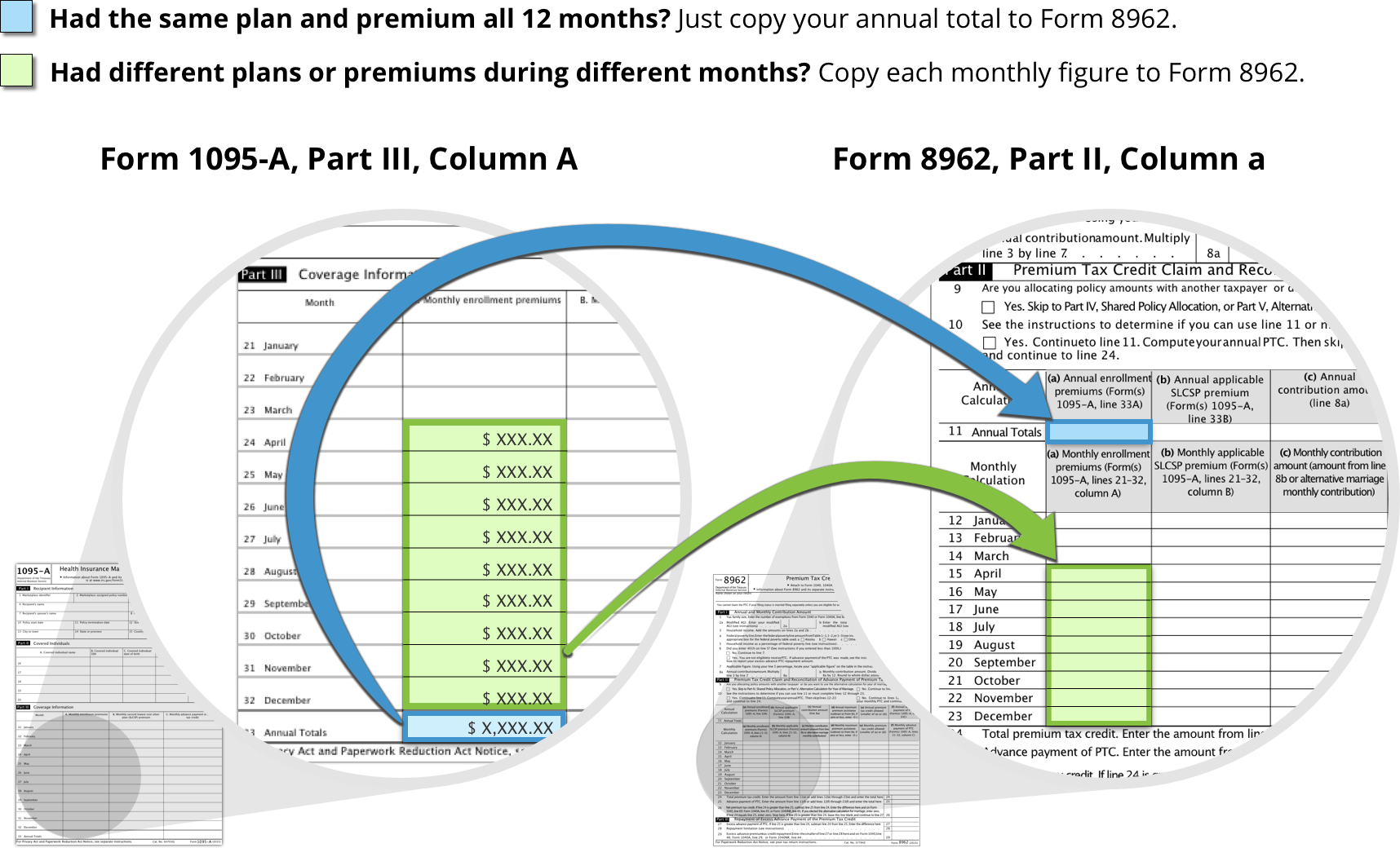

| Enrollment Premiums | Part Iii: Cavalcade A Annual amount: line 33 Monthly amounts: lines 21 — 32 | Part Ii: Cavalcade a Annual amount: line eleven Monthly amounts: lines 12 — 23 | Quick view |

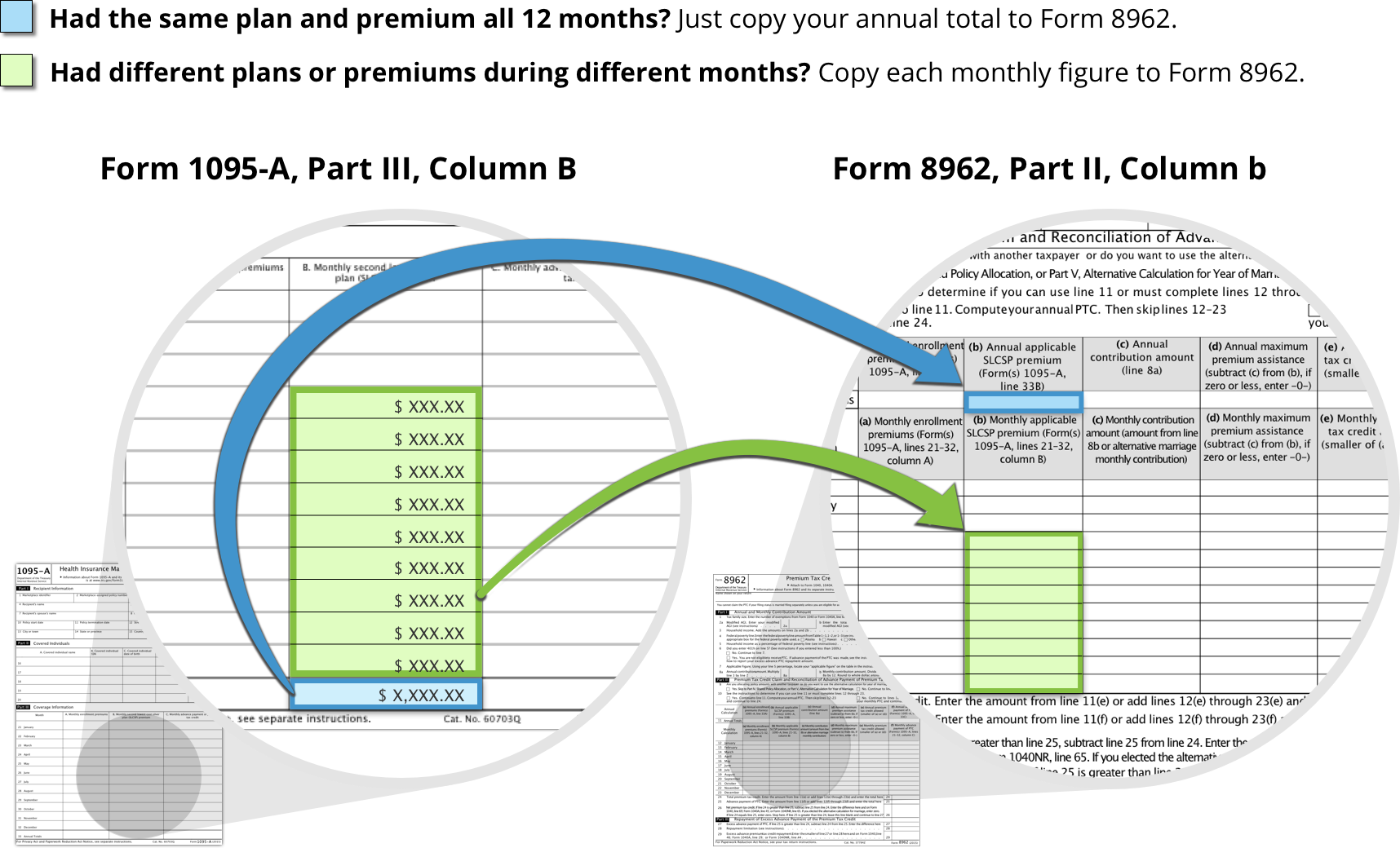

| Second lowest cost Silver plan (SLCSP) premium | Part Iii: Column B Annual amount: line 33 Monthly amounts: lines 21 — 32 | Role Ii: Column b Annual amount: line 11 Monthly amounts: lines 12 — 23 | Quick view |

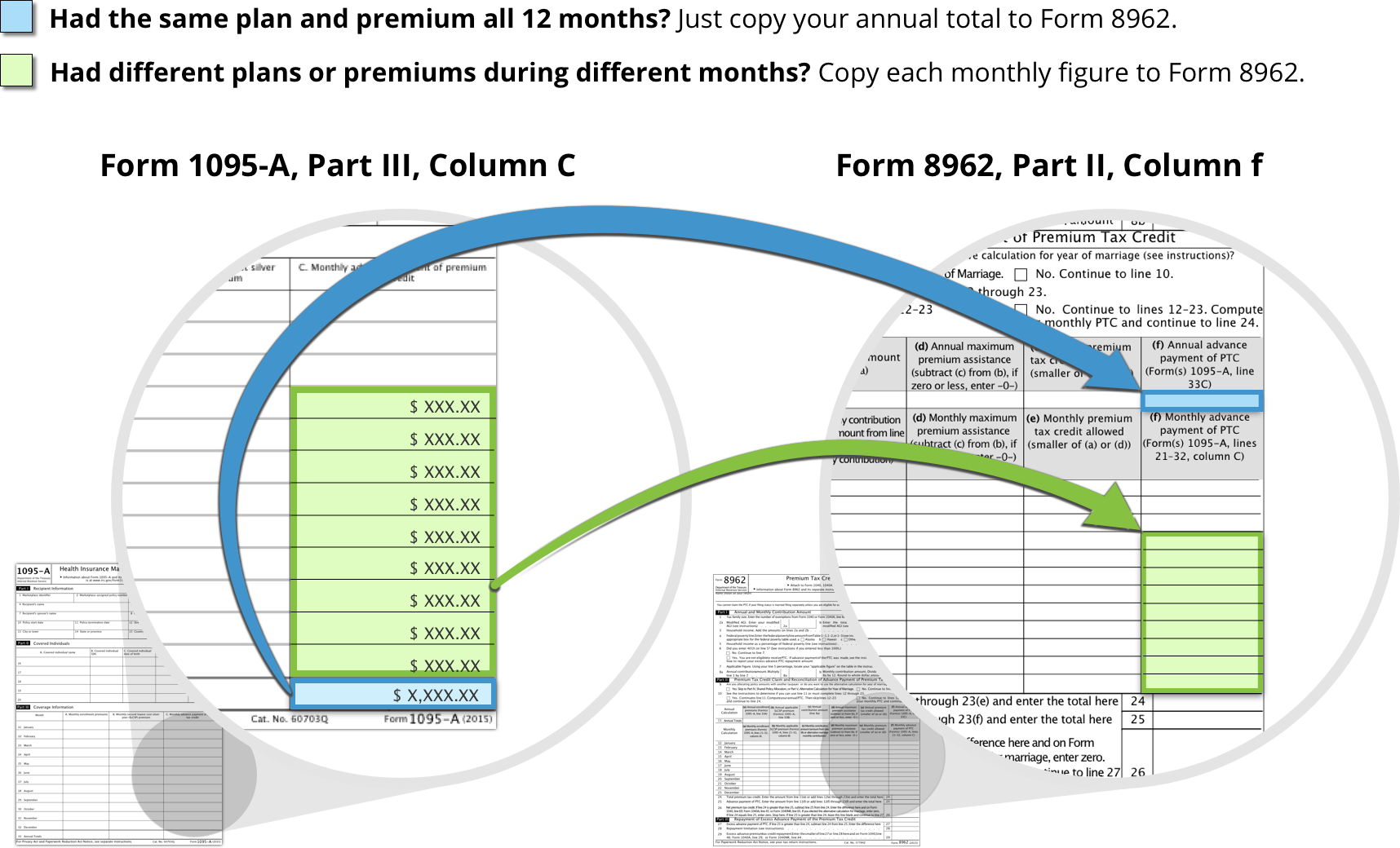

| Advance payment of premium tax credit | Part Iii: Column C Annual amount: line 33 Monthly amounts: lines 21 — 32 | Function II: Cavalcade f Annual amount: line xi Monthly amounts: lines 12 — 23 | Quick view |

-

Complete all sections of Course 8962. On Line 26, you'll find out if you used more than or less premium tax credit than you authorize for based on your final 2021 income. This will touch on the corporeality of your refund or tax due.

-

Include your completed Course 8962 with your 2021 federal tax render.

Get a notice telling you to file and "reconcile" 2020 taxes?

If y'all were enrolled in a 2021 Marketplace program but didn't file and "reconcile" your 2020 taxes, y'all'll get a observe proverb you lot may lose the financial help you're getting for your 2022 plan. You may likewise get "Letter 0012C" from the IRS.

- If you oasis't filed your 2020 tax return — or filed a return but didn't "reconcile" the premium taxation credit for all household members — yous must do so immediately.

Your notice volition provide details. If you ostend that you lot filed your 2020 taxation render, you won't need to do anything else.

Questions on 2020 taxes?

- Confirm your tax filing status for 2020 using the Interactive Tax Assistant from the IRS.

- Run across all 2020 tax filing information from HealthCare.gov.

How to move enrollment premium info to Form 8962

How to move Second Lowest Cost Silver Programme (SLCSP) Premium info to Form 8962

How to movement Advance Payment of Premium Tax Credit info to Form 8962

Source: https://www.healthcare.gov/taxes-reconciling/

Posted by: maguirepeetruse.blogspot.com

0 Response to "Can I Get Partial Money Back From Health Insurance Premium Tax 2017"

Post a Comment